Forecasting Lies: Why Your Pipeline Looks Full but Closes Empty

Talewind

·

2 minute read

Talewind

·

2 minute read

Every sales leader has faced it. The pipeline looks strong, the board is confident, and then quarter end comes. Suddenly half the deals evaporate. Forecast accuracy tanks. Credibility slips.

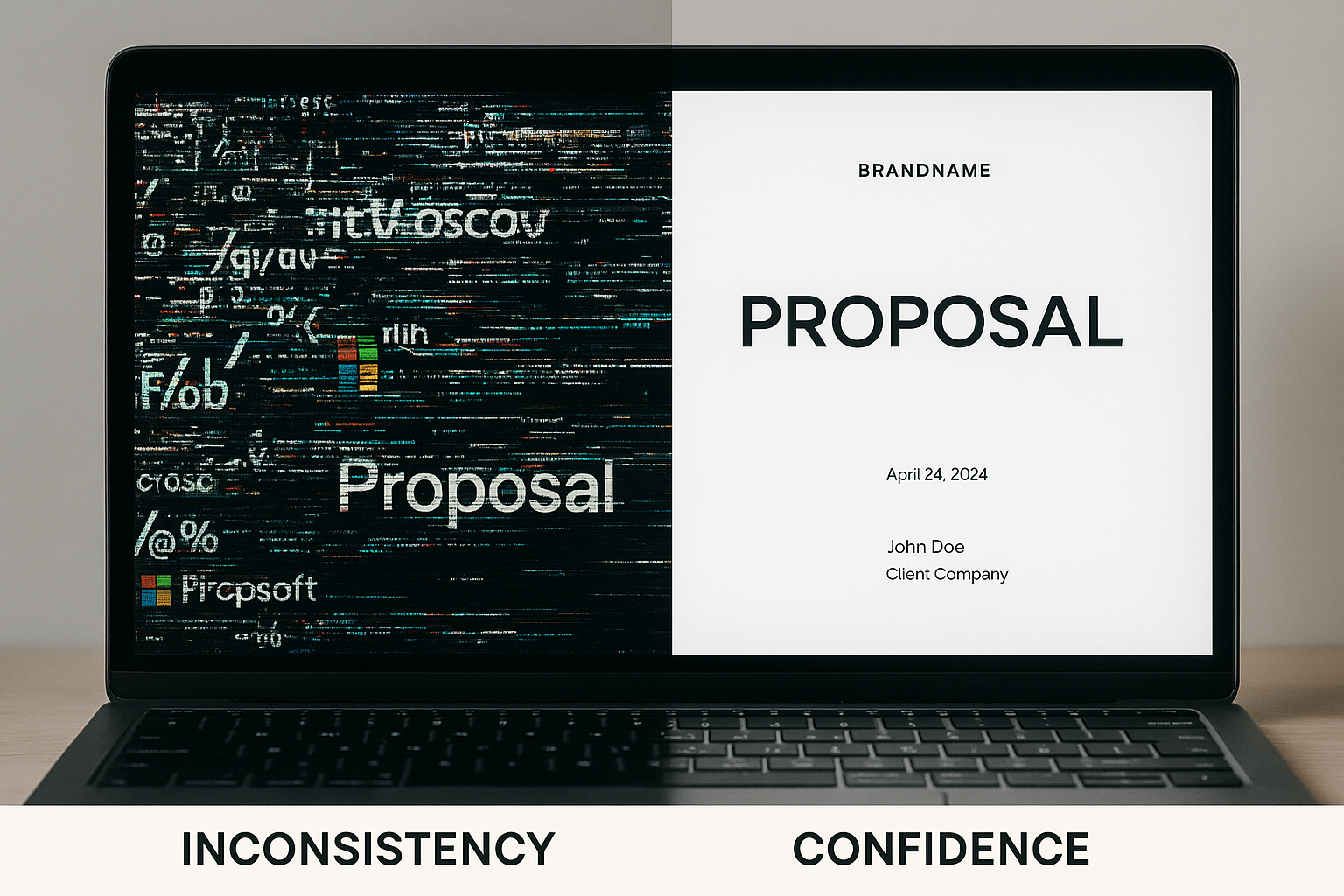

Why does this keep happening? Because proposals distort your pipeline more than any other stage — and most teams never notice it until it’s too late.

The Forecast Mirage

Here’s the lie hiding in your pipeline.

Deals marked “in proposal” look like progress. Leadership assumes they are moving toward close.

In reality, they are stuck. Proposals sit in endless review cycles, formatting edits, or worse — buyer silence.

Your pipeline isn’t full. It’s inflated. And that’s why your forecast fails.

¹ According to Salesforce’s *State of Sales Report 2023*, sellers spend less than 30% of their time actually selling, with administrative tasks like proposals eating up the rest. That dead time inflates forecasts with deals that aren’t moving.

Why Proposals Break Forecasts

Time-in-stage blind spots. CRMs track deal count, not velocity. A proposal sitting for 30+ days still shows as “active,” even when it’s already dead.

Approval bottlenecks. Legal and finance reviews often turn into black holes. The forecast assumes deals are advancing, but in reality, they’re just waiting.

Rep optimism. Sellers keep deals “alive” in CRM long after buyers have gone cold. Leadership sees inflated numbers and plans accordingly.

Quick Self-Check: Is Your Forecast Inflated?

You might be if:

- “Proposal Sent” is your largest stage by deal value.

- Forecast accuracy is consistently off by more than 20%.

- Deals often slip into the next quarter marked “pending proposal.”

- Leadership is surprised every QBR when pipeline reality doesn’t match the report.

The Fix: Forecast with Proposal Discipline

Accurate forecasting requires treating proposals as a measurable stage — not administrative noise.

Track proposal aging. Deals in “proposal” longer than 21 days should auto-flag for review. Create alerts when proposals stall.

Tie confidence to velocity. Forecast weighting should drop as proposal cycle time rises. Example: 80% confidence if sent in less than 7 days, 20% if over 21 days.

Automate stage hygiene. Auto-close proposals that stall past a defined threshold. Keep the pipeline clean so forecasts reflect reality.

Report proposal metrics to the board. Include proposal cycle time in every forecast update. Show how orchestration improves accuracy, not just volume.

The Payoff: Forecasts the Board Can Trust

When proposals move fast and predictably, forecasts become **accurate, not optimistic.**

Leadership trusts the numbers and the sales team. Revenue visibility improves across the organization.

² Gartner reports that companies that implement orchestrated workflow automation achieve 30% higher forecast accuracy than those with fragmented processes (*Process Automation Architecture, 2023*).

Your Next Steps

- Run a report: what is the average age of deals in “Proposal Sent”?

- Compare win rates for proposals delivered in less than 7 days vs. more than 21 days.

- Reset forecast weighting using those insights to add confidence scores.

Because a pipeline full of stalled proposals isn’t revenue. It’s a mirage. Until you fix your proposal process, your forecasts will keep betraying you.